wa sales tax finder

These usually range from 4-7. WA Sales Tax Rate Lookup is an Android Business app developed by WA State DOR and published on the Google play store.

Washington State Sales Use Tax Location Code Boundaries Overview

On top of the state sales tax there may be one or more local sales taxes as well as one or more special district taxes each of which can range between 0 percent and 39 percent.

. App users can search using their current location or by looking up an address. The average local rate is 269. Lookup other tax rates.

Local tax rates in Washington range from 0 to 39 making the sales tax range in Washington 65 to 104. Washington became a full member of the Streamlined Sales and Use Tax Agreement by conforming its legislation effective July 1 2008. Once this app has cached the sale tax data from the states website which happens on start up youre good to go until the next quarter.

Use tax is calculated at the same rate as the sales tax at the purchasers. For example the state rate in New York is 4 while the state sales tax rate in Tennessee is 7. Use the WA Sales Tax Rate Lookup app to find current Washington sales tax rates quickly and easily from anywhere you use your mobile device.

The Washington WA state sales tax rate is currently 65 ranking 9th-highest in the US. Lodging information and rates. Use this app to find current Washington sales tax rates quickly and easily from anywhere using GPS at your current location or by searching for an address.

Washington imposed its retail sales tax and compensating use tax to supplement the retail sales tax beginning in 1935. The WA Sales Tax Rate Lookup app provides the current local sales tax rates and calculates the amount of sales tax to charge. Tax rate change notices.

To calculate sales and use tax only. Use this search tool to look up sales tax rates for any location in Washington. List of sales and use tax rates.

31 rows The latest sales tax rates for cities in Washington WA state. Currently combined sales tax rates in Washington range from 65 percent to 104 percent depending on the location of the sale. Washington has a 65 statewide sales tax rate but also has 105 local tax jurisdictions including cities towns counties and special districts that collect an average local sales tax of 2368 on.

To determine the proper codes and rates of local sales tax you may access our Tax Rate Lookup Tool located at dorwagov. It has gained around 10000 installs so far with an average rating of 40 out of 5 in the play store. The average combined tax rate is 919 ranking 4th in the US.

Decimal degrees between -1250 and -1160. This level of accuracy is important when determining sales tax rates. Information and rates for car dealers leasing companies.

Use tax is a tax on items used in Washington when sales tax hasnt been paid. From there it can determine the corresponding sales tax rate by accessing AvaTax our innovative cloud-based sales tax calculation product. Tax rate lookup mobile app.

Depending on local municipalities the total tax rate can be as high as 104. Local taxes apply to both intra-state and inter-state transactions. Ad Lookup Sales Tax Rates For Free.

The state sales tax rate is the rate that is charged on tangible personal property and sometimes services across the state. The Washington state sales tax rate is 65 and the average WA sales tax after local surtaxes is 889. Just enter the five-digit zip code of the location in which the transaction takes place and we will instantly calculate sales tax due to Washington local counties cities and special taxation districts.

Find the TCA tax code area for a specified location. Washington sales tax rates vary depending on which county and city youre in which can make finding the right sales tax rate. The calculator will show you the total sales tax amount as well as the county city and special district tax rates in the selected location.

Other local-level tax rates in the state of Washington are quite complex compared against local-level tax rates in other states. The base state sales tax rate in Washington is 65. Find your Washington combined state and local tax rate.

Build your own location code system by downloading the self-extracting files to integrate into your own accounting system. This notice is being sent to businesses that have reported local sales or use tax to any of the above location codes within the last year. When you enter the street address the calculator uses geolocation to pinpoint the exact tax jurisdiction.

Whether youre in the office out on the job site or having an item. Download WA Sales Tax Rate Lookup for Android to wA State Sales Tax Rate LookupWashington State Department of Revenue Use this app to find the sales and use tax rate and code for any location in. Decimal degrees between 450 and 49005 Longitude.

The app has the most current local sales tax rates making it easier calculate or verify a charge. When you purchase a vehicle or vessel from a private party youre required by law to pay use tax when the vehicle or vessel title is transferred. Business info including location business activities bank name etc.

In some states the sales tax rate stops at the state level. Depending on local municipalities the total tax rate can be as high as 104. The Washington WA state sales tax rate is currently 65.

As a business owner selling taxable. WA Sale Tax Lookup is architected as a standalone application or microservice so that youre not dependent on the State of Washingtons IT infrastructure. The WA Sales Tax Rate Lookup always has the most up-to-date local sales tax rates available making it easy to calculate or verify a charge.

On the home page click on the Find a sales or use tax rate link. --ZIP code is required but the 4. Use tax rates.

Find your Washington combined state and local tax rate. Interactive Tax Map Unlimited Use. When the state updates the sale tax rates the app.

Find Sales tax rates for any location within the state of Washington. You need this information to register for a sales tax permit in Washington. Determine the location of my sale.

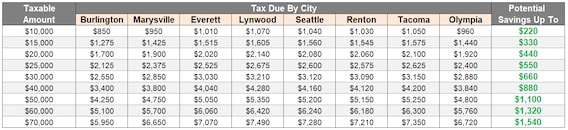

Auto Sales Tax Calculator Buy A Vw Near Marysville Wa

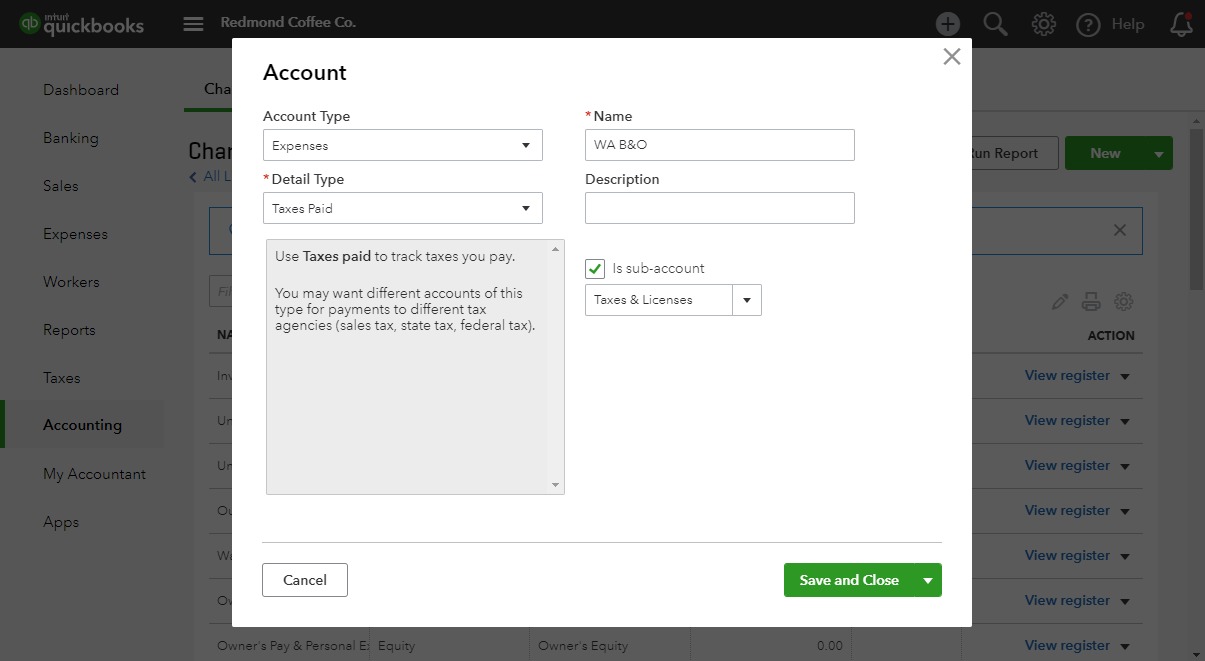

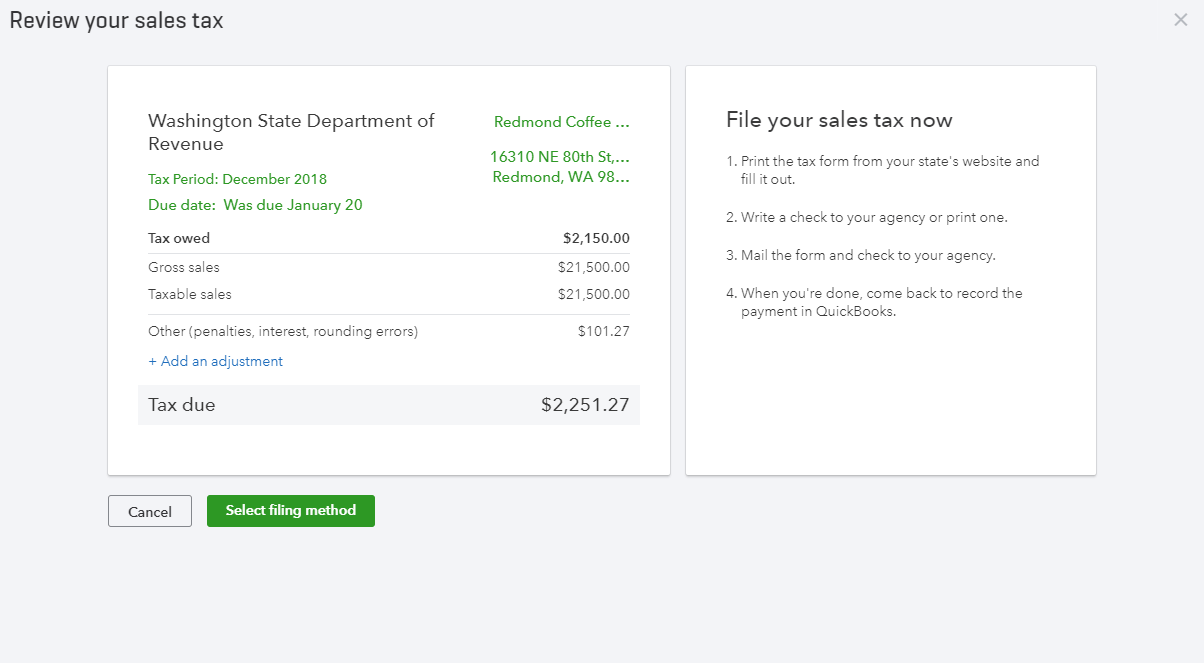

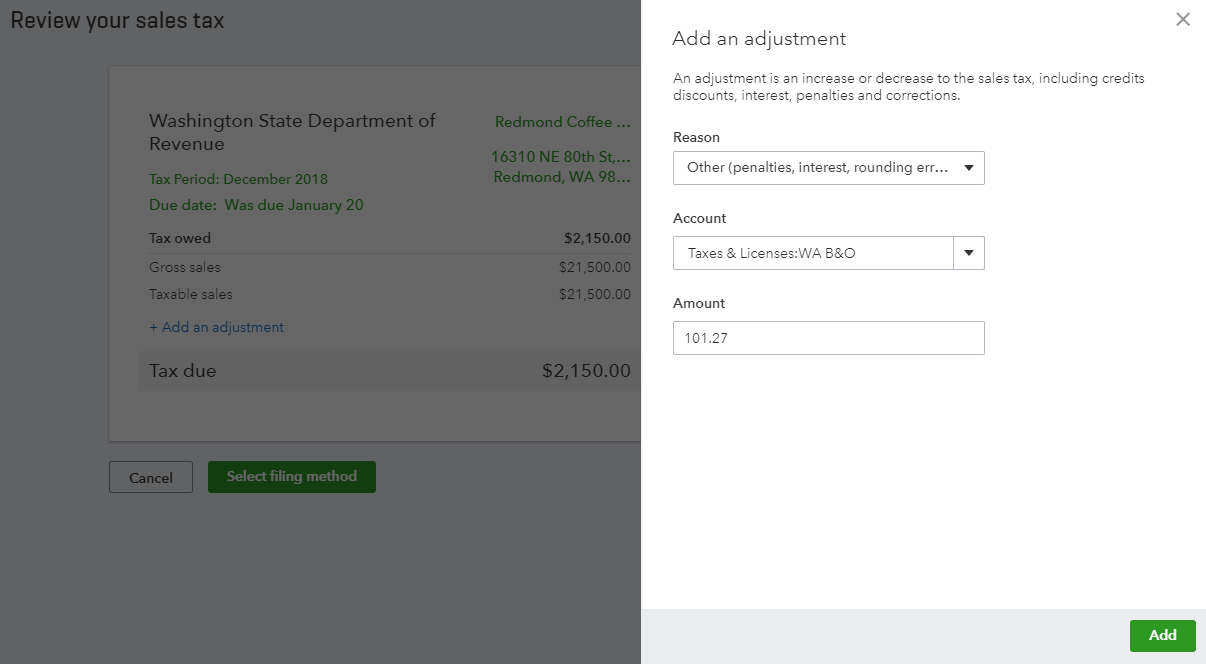

How To Record Washington State Sales Tax In Quickbooks Online Evergreen Small Business

Washington Sales Tax Guide And Calculator 2022 Taxjar

2022 Sales Taxes State And Local Sales Tax Rates Tax Foundation

Washington Income Tax Calculator Smartasset Com Travel Usa Seattle Ferry Travel

Printable Washington Sales Tax Exemption Certificates

Washington Sales Tax Rates By City County 2022

How To Record Washington State Sales Tax In Quickbooks Online Evergreen Small Business

How To Record Washington State Sales Tax In Quickbooks Online Evergreen Small Business

Washington Sales Tax Information Sales Tax Rates And Deadlines

Is Software As A Service Saas Taxable In Washington Taxjar

Washington Sales Tax Small Business Guide Truic

Washington Income Tax Calculator Smartasset

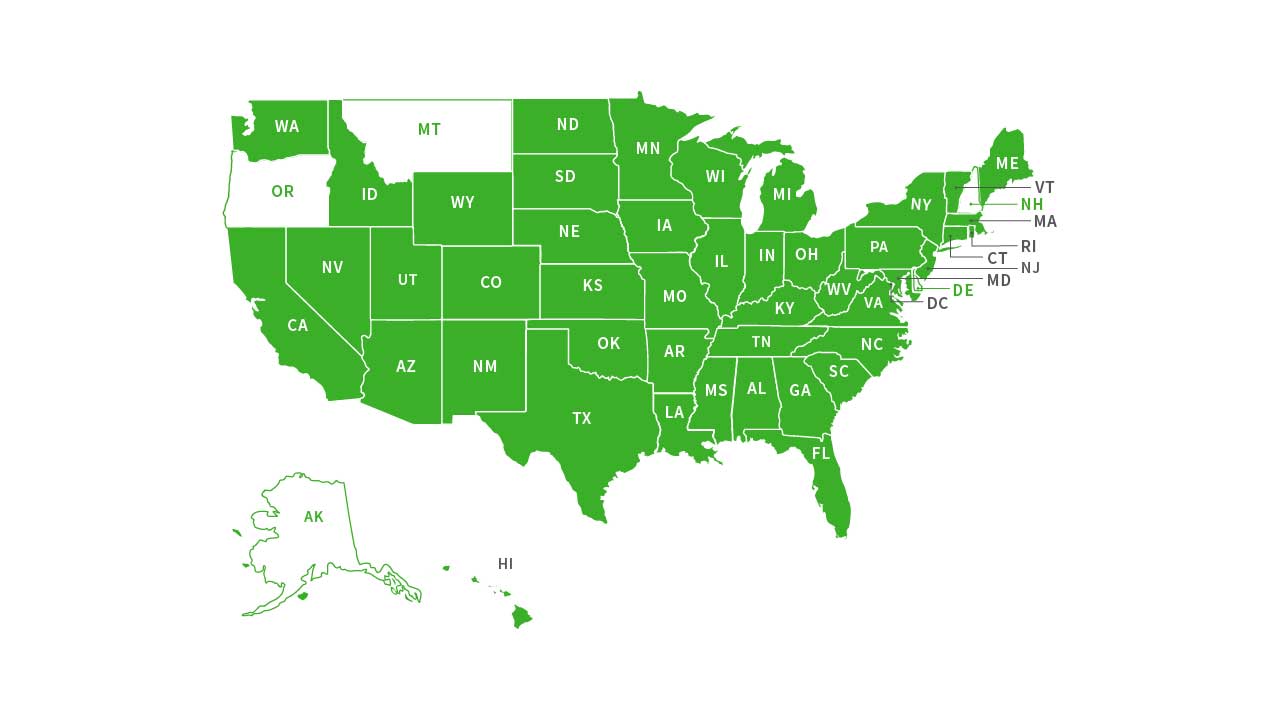

States With Highest And Lowest Sales Tax Rates

The Consumer S Guide To Sales Tax Taxjar Developers

Taxjar State Sales Tax Calculator Sales Tax Tax Nexus

Seattle King County Realtors Higher End Homes Hit By Excise Tax Rate Increase